Key Growth Suburbs in Australia #4 Lovely Banks

Key Growth Suburbs in Australia #3 Coolum Beach

Key Growth Suburbs in Australia #2 Corio

Key Growth Suburbs in Australia #1 Forster

Building Site Temporary Closure

Temporary Closure

The Victorian Government announced that from 20th September 2021 at 11:59pm all building sites across metropolitan Melbourne and the municipalities of Geelong, Mitchell, Surf Coast, and Ballarat will be closed for a fixed period of 2 weeks, ending on 5th October 2021.

The Government has stated that construction sites in regional areas that come out of lockdown before the 5th October may be able to reopen earlier.

While this proves to be a difficult situation for the 30,000 small-scale residential building projects that are currently under construction across the state, the closure applies to all large and small construction sites, including home renovations.

We understand the frustration that this news may bring and we thank you for your patience, especially to those clients who have builds that were scheduled to commence over the next 14 days, and to those who have builds that are currently underway.

Should there be any changes to the situation, we will be in touch to keep you informed and up-to-date.

If you are after more information or if you have any questions, please reach out and we will endeavour to assist you as best we can.

Improving Your Lockdown

To support all of our valued clients, family, friends, and colleagues during this unprecedented time, we've compiled a list of great tips and resources to assist you with reducing stress, enhancing your wellbeing and the wellbeing of your friends and family, while also giving you some inspiration of fun and productive things to do during lockdown.

The pandemic has affected our lives in many ways. As we stay home to reduce the spread of the virus, we may feel lonely and isolated due to limited connection with others, or perhaps some of us are working through other challenges. You may feel worried about loved ones and be managing new responsibilities such as working from home and homeschooling, studying online, or you may currently be out of work. With uncertainty about the future, it is understandable to feel distressed and anxious. In fact, it is natural to feel that way.

If these feelings are interfering with your daily routine, or if you feel overwhelmed, it is important to make positive changes to enhance your sense of well-being. When you feel well, you will be better able to cope with stressors, and you will be able to move through this challenging time with even just a little bit more ease.

Reducing Stress & Enhancing Wellbeing

When many things feel uncertain or out of our control, one of the most effective ways we can manage stress and anxiety is to focus on the actions that are in our control. Here are some ways you can take intentional steps to look after your physical and emotional wellbeing during this challenging time:

Maintain your day-to-day activities and a routine as much as possible

Having a healthy routine can have a positive impact on your thoughts and feelings. Go back to basics - eating healthy meals, physical exercise (e.g., walking, stretching, running, cycling), getting enough sleep, and doing things you enjoy. Even if you're in quarantine, or working from home, there are many ways to develop new routines and stay healthy.

Do the things you enjoy

Take your mind off your worries by making sure you allow plenty of time for enjoyable activities. This could include listening to music, reading, gardening, spending time connecting with family and friends online, making your friends care packages or writing them letters, or doing a short course online. Starting a project, like making a gift for a friend, can provide a goal to work towards and give you a great sense of achievement when complete. It's natural for our minds to think of all the usual activities we may not be able to do at the moment.

Make a conscious shift to focus on the activities we are still able to do or those that we may have more opportunity to do if we're at home more often.

Here is a list of some fun and productive things you can do at home.

Set limits around news and social media

It’s understandable to want to keep informed and prepared. At the same time, constantly reading, watching, or listening to upsetting media coverage can unnecessarily intensify worry and agitation. Schedule a specific time to check in with the news instead of acting on every urge you have to tune in. It's also okay to take breaks from conversations with others about the pandemic and suggest talking about other topics.

Exercise regularly

Physical exercise can help relieve tension and relax your body and mind. Try to do some physical exercise every day, even if it’s just going for a walk around the block or doing some star jumps in your backyard. There are plenty of great online workouts available which are great for both your physical and mental health.

Here is a list of the top 20 workouts on YouTube.

Contribute

Showing care towards friends, family, or vulnerable people in our community can be all the more important during times like this. It can foster a sense of hope, purpose, and meaning. Some ideas can be to: send someone you care about a message of encouragement or affirmation; cook and deliver a meal to someone in your neighbourhood; or donate to a cause that means something to you.

Here is a list of popular charities in Australia.

Keep things in perspective

In a situation that’s uncertain, it’s natural to have many what if? questions in our minds. In the absence of information, our anxious mind will often fill in the blanks with worst-case scenarios, which can leave us feeling overwhelmed, helpless, or vulnerable. Here are some questions you can ask yourself to shift your thinking from catastrophizing to a more helpful mindset:

What are the things within my control?

Am I overestimating the likelihood of the worst-case scenario?

What strategies have helped me cope with challenging situations in the past that will serve me well during this time?

What is a small helpful or positive action that I can take now?

Try to relax

Relaxing does always come easy. Some of us need to practice relaxing by setting up a time each day to take deep breaths, consciously relax our bodies, and calm down our racing thoughts. Incorporating breathing and muscle relaxation exercises into your daily routine may be helpful, and these types of exercises can also be used as short-term coping strategies.

Here is a link to a short and simple breathing technique called 'box breathing' that works to bring you back into a state of calmness.

Things To Do

While what we can do is limited, Time Out has put together a great list of things that we can do in Melbourne and beyond during this week of lockdown. Time Out's suggestions include:

1. Take a virtual class to learn a new hobby such as making gnocchi, blending wine, making your own herbal remedies, be your own barista, and the list goes on!

2. Create a fun outdoor dining experience

3. Stream the online program for the 35th Melbourne Writers Festival

4. For the kids: celebrate Nature Book Week with free online talks and live readings.

Here is the link to what's on in lockdown!

We are living through an unprecedented and uncertain time, requiring each of us to navigate our way, as best we can, through a rapidly evolving global health crisis. With things changing so quickly, such uncertainty and unpredictability can take a toll on our mental and physical health. Managing our emotions and supporting each other can be challenging at the best of times. This is why, more than ever, we all need to be doing our best to regularly pause, take a breath and be proactive in looking after ourselves and others.

As always, we are here to support you all as best we can, so please reach out if you need some assistance.

Victoria's Infrastructure, Population & Property

Infrastructure Victoria’s 30-Year Strategy provides an opportunity to kickstart Victoria’s economic recovery. The strategy contains 94 recommendations on infrastructure planning, with a strong focus on infrastructure in growing communities around Melbourne and regional Victoria. Victoria’s infrastructure and transport system must develop and adapt to the changing needs of Victoria’s people and economy. Our population is expected to grow by over 4 million people by 2051 and as demographics change, so do our infrastructure and transport system demands.

Within this article, we outline expected population change in both Melbourne and regional areas of Victoria as well as evidence-based research on new growth areas in Melbourne’s fringe suburbs. We look at the property market and how infrastructure can boost economic development and strengthen the resilience of economies, communities, and individuals.

Population

Victoria’s population is estimated to increase from a current 6.6 million to 10.8 million by 2051. Working from home has become the new normal, and in line with this considerable change, the population in Melbourne’s inner suburbs are expected to drop while suburbs in outer Melbourne and regional Victoria are expected to rise. With the majority of jobs across Victoria located in Melbourne's CBD, the need to improve transport and infrastructure to accommodate growth areas and an increasing number of commuters is essential.

People who are working from home are likely to continue moving further out of Melbourne into more affordable areas, and as such, Melbourne’s inner suburbs are expected to see a 3.6% drop in expected growth. With the CBD being the home of the majority of new jobs now and in the future, the anticipated increase in people commuting to the CBD calls for better transport connections across the state. The map below outlines the expected change in population across Victoria by 2036.

New Growth Areas

The populations of seven designated growth areas on the outskirts of Melbourne are experiencing rapid population growth, encouraged by affordable housing for residents. Including parts of Cardinia, Casey, Hume, Melton, Mitchell, Whittlesea, and Wyndham, these growth areas are expected to become home to over 930,000 more people by 2036. This is roughly equivalent to adding the population of around 10 cities the size of Bendigo, and represents over 40% of projected statewide growth.

While the pandemic temporarily slowed population growth, many more Victorians will continue to call these designated growth areas home. The extra people moving to these areas will require new homes, and that means building many thousands of new dwellings. To provide residents with access to employment, services and amenities, considerable investments have been proposed in many types of infrastructure, including utility connections, roads and public transport, schools, hospitals, community infrastructure and telecommunications.

Property Market

Time and time again, evidence-based research is pointing to the advantages of investing in Melbourne’s fringe suburbs and in regional Victoria. With the pandemic prompting people residing in Melbourne to move further out of the city, regional Victoria’s population is on the rise and this growth is expected to continue over the long-term. There is no doubt that now is an ideal time to consider investing in Melbourne’s fringe suburbs and in regional Victoria.

To conclude, infrastructure can boost economic development and strengthen the resilience of economies and communities. With regional Victoria’s population expected to almost double by 2051, Victoria is investing in transport infrastructure and services to give communities in regional Victoria the quality services they deserve. These investments will make it easier for people to access jobs, education and services as well as making the lifestyle in new growth areas all the more appealing to residents and investors alike.

If you have any questions at all, please reach out.

We would love to hear from you.

Brisbane Olympic Games & Real Estate

The Olympics are coming back to Australia as Brisbane has been elected to host the Games in 2032. The International Olympic Committee's decision has placed a global media spotlight on Brisbane and South-East Queensland. Planning is already underway to create the infrastructure needed to host the event in addition to the influx of athletes, officials, and tourists across Brisbane, the Gold Coast, and the Sunshine Coast.

According to Terry Ryder, "The investment activity and media focus will create national and international interest in the affordable lifestyle offered by the Gold Coast, Brisbane, the Sunshine Coast, and all of Queensland. The next 10 years will be a great time to own Queensland real estate."

Billions of dollars are set to be poured into upgrading Brisbane and surrounding areas, and the impact this is going to have on the housing market is undeniable.

Infrastructure Upgrades

The Brisbane Olympic and Paralympic Games are set to cost around $5 billion. It’s important to note that the Olympics won’t be entirely hosted in Brisbane. Sporting venues on the Gold Coast and Sunshine Coast will be utilised in addition to venues in Redland, Moreton Bay, Scenic Rim, and Ipswich.

According to the Brisbane 2032 Olympic Plan, 84% of venues used will be existing or temporary. This will include 3 main hubs throughout the state, which will host 28 different sports. Of these venues, 21 will be in Brisbane, 7 on the Gold Coast, and 4 on the Sunshine Coast.

The Gabba Stadium will host athletics events, as well as the opening and closing ceremonies. The stadium will also receive a $1 billion rebuild, which will increase the stadium’s capacity from 42,000 to 50,000 seats.

In regards to new venues, there will be a 15,000-seat aquatic centre built in Brisbane’s CBD in addition to a 12,000-seat basketball facility and a 10,000 seat gymnastics and boxing centre.

An athlete’s village will be built on the Brisbane waterfront, with alternative accommodation available on the Gold Coast, Sunshine Coast, and Kooralbyn.

For spectators, travel throughout the games will be aided by the completion of the Cross River Rail, Brisbane Metro, and Coomera Connector.

How are property markets likely to benefit from the Olympic Games?

The most significant positive influence on the housing market is likely to be seen in the years leading up to the Olympics, rather than during the 4 weeks of the Games themselves.

According to Tim Lawless from CoreLogic, "Large infrastructure projects tend to have a positive influence on housing prices, with the extra requirement for workers creating additional demand for housing during the construction process. Large projects also tend to leave a legacy of a permanent housing demand uplift, either through additional employment or via other benefits such as improved transport options and travel efficiencies related to transport infrastructure projects as well as additional amenities introduced to the area including social and retail outlets."

Brisbane's median house price sits just under $700,000 yet some economists tip this figure will more than double by the time the Games roll around in 2032.

Brisbane real estate agent Col Kelaart recently commented, "For now at least, if you're coming from another capital city to buy in Brisbane, you'll have plenty of change left in your pocket, but the figures will almost certainly double by 2032, especially in key infrastructure suburbs."

At the top of the rank is Hamilton, where the Olympic village will be built and the median house price is already about $1.6 million. It's likely to jump to more than $3 million within a decade. Real estate in Tennyson, where the Games' tennis tournament will be staged, is expected to rocket from $970,000 to about $2 million. Chandler, which will host the gymnastics, is forecast to soar from $1.6 million to $3 million, while Woolloongabba will probably reach $2 million from a current median of $950,000.

In addition to being a win for the housing market, The State Government’s 2032 Olympic and Paralympic Taskforce found the Games could create around 130,000 direct jobs, including 10,000 in the year of the Games. The Value Proposition Assessment created by the task force also revealed there is an estimated quantifiable economic benefit of $7.4 billion.

In conclusion, housing markets in Brisbane, the Gold Coast, the Sunshine Coast, and surrounding suburbs are expected to flourish over the next decade. The planned infrastructure upgrades taking place to accommodate the 2032 Olympic and Paralympic Games are set to make locations around Queensland even more desirable.

If you have any questions about housing markets in Brisbane or surrounding suburbs, please get in touch.

Proposed Negative Gearing & Capital Gains Cuts

After several years of pursuing policies aimed at changing negative gearing and capital gains tax deductions for investors, the Labor government has finally axed their proposals and committed to leaving negative gearing and capital gains arrangements alone. This is good news for investors who have been unsure whether investing in Australia’s property market is a calculated step to take, and it’s also good news for renters.

What exactly were the cuts Labor was proposing?

Labor’s capital gains tax policy proposed halving the 50% tax discount on assets that were sold after having been held for at least 12 months. Their negative gearing policy would have confined the tax deduction to newly-built properties. Both policies, first flagged in 2015, exempted assets that were already held and would only have applied to those purchased after the policies became law.

The abolishment of negative gearing on investment properties proposed the risk that rental prices would increase. It has been argued that any changes to negative gearing would result in increased rental prices, based on rental increases between 1986 and 1988 when the Hawke Government extinguished negative gearing deductions. After 2 years of abolishment, the Hawke Government reinstated full negative gearing in 1987.

The Property Council of Australia suggested Labor’s decisions are a welcome recognition that these policies would have hurt the economy, cost construction jobs, and had little impact on housing affordability.

Here is an example of how negative gearing works:

Let's say you bought an investment property that earns you $25,000 per annum. Your mortgage repayments are $22,0000 per annum and you have an additional $7,000 in property expenses, therefore your investment property costs you $29,000 per year. Considering your investment earns you $25,000 per year, you are $4,000 out of pocket and because you are out of pocket, your property is negatively geared.

So, how is negative gearing a positive for investors?

Let’s say your income is $85,000. As you have $4,000 worth of annual expenses on your investment property, you are only going to pay tax on $81,000. There is an incentive for people to invest because if the investment is hurting your cash flow, you can offset against it.

Who are the winners and losers in this situation?

Labor’s proposed cuts negatively affected those who were thinking about investing as there was uncertainty whether negative gearing and capital gains were eventually going to be taken away. The change in policy provides a lot more certainty for renters too, as it will relieve some of the pressure that we are now seeing on rental stock by allowing more people to contemplate taking on an investment, making more properties available for the rental market. The rental market needs more properties out there as there is a lot of squeeze on rental prices in both cities and regional areas of Australia.

The losers in this situation are those who are not yet in the market and first home buyers - auctions will continue to be competitive with seasoned investors ruling the market.

Overall, if you are considering getting into the property market then the recent news that negative gearing and capital gains tax deductions are going to be left alone by the Labor Government is a positive. If you’ve got any questions or would like to know more, please reach out.

Brisbane Suburb Profile

As Australia's third-largest city, Brisbane offers a large and diverse market for property investors. With a steadily increasing population, employment opportunities across a vast range of sectors, major plans for infrastructure, high-quality education facilities, and affordable housing, Brisbane has much more to offer than just an enviable lifestyle.

Median Property Prices

Brisbane has historically enjoyed strong population growth and economic performance, which has driven attractive returns for investors. Over the past few decades, Brisbane property has achieved excellent long-term capital growth and in the 2020-2021 period, Brisbane has seen record-breaking growth. A perfect storm of conditions including lower interest rates, wage growth, and the COVID-19 pandemic, have led to a stratospheric rise in property prices.

According to eChoice, the current median property price across all properties in the Greater Brisbane region is $548,260. In April 2021, median house prices in Brisbane were $607,969, compared to $503,265 the previous year. The average median value of a house in Brisbane is $607,969, while units have a median price of $400,866.

Home values have increased by 6.2% in the past three months to be up more than 10% annually. Homeowners in Brisbane’s most popular inner suburbs are now earning up to $50,000 per month in capital gains.

According to Tim Lawless from CoreLogic, the combination of improving economic conditions and low-interest rates is continuing to support consumer confidence which in turn has created a persistently strong demand for housing. At the same time, advertised supply remains well below average. This imbalance between demand and supply is continuing to create urgency among buyers, contributing to the upwards pressure on housing prices. The pace of capital gains has slightly slowed since the end of March, seen in the lower rate of growth in home values, and a softening in auction clearance rates. However, housing values are still currently rising faster than the peak rate of growth in recent cycles.

Market Forecast

NAB had previously predicted a rise of 14% across all capital cities over 2021, but NAB chief economist Alan Oster said the bank had upgraded this to a 16% rise in Brisbane.

ANZ economists forecast Brisbane house prices will rise by 9.5% next year, as low-interest rates and government stimulus flow through the economy.

CBA now expects Brisbane house prices to increase by 16.6% to December 2022 compared to 13.7% in Sydney and 12.4% in Melbourne.

Westpac has also updated its property forecasts, with Brisbane real estate prices tipped to surge 20% between 2022 and 2023.

Rental Returns

Brisbane's real estate continues to enjoy strong rental yields, despite falling interest rates. Investment property yields in Brisbane have consistently tracked almost a percentage point higher than in Sydney and Melbourne. Average rental returns in Brisbane are as follows:

Houses = 3.63%;

Townhouses = 4.81%

Apartments = 4.72%

Population Growth

Approximately 2.2 million people call the Greater Brisbane region home. According to the most recent census in 2016, the populace is young and skilled with 42.8% aged 25 to 54; well-educated with 22% having bachelor degrees; and culturally diverse with 18% of Brisbane households speaking a foreign language at home. Thanks to a high level of skilled migration, Brisbane has embraced an international sophistication and inherited an exceptional talent pool that displays both depth and breadth.

Brisbane has been one of the pacesetters for population growth in Australia for two decades. The population of Greater Brisbane is expected to grow to 3.18 million by 2031 with Brisbane leading the way as one of the fastest-growing capital cities in the country, according to Queensland Government Statisticians Office.

Employment

Categorised as a global city, Brisbane is among Asia-Pacific cities with the largest GDPs and is one of the major business hubs in Australia with strengths in mining, banking, insurance, transportation, information technology, real estate, and food.

The major employment sectors in Brisbane include health care and social assistance, professional, scientific, and technical services, retail trade, and education and training.

The 2016 census shows that 92.6% of Brisbane's population were employed, of which 58.8% were employed full-time. The unemployment rate in 2016 was 7.4%.

Some of the largest companies headquartered in Brisbane, all among Australia's largest, include Suncorp Group, Virgin Australia, Aurizon, Bank of Queensland, and Flight Centre.

Infrastructure

Brisbane is built on a strong foundation of infrastructure with major projects including a world-class international airport, a busy international port, a comprehensive road, and rail network, a fully integrated public transport system, vibrant entertainment, and sporting venues, and an exceptional range of accommodation options.

With a strong vision for the future, the Brisbane City Council and Queensland Government’s long-term commitment to invest in critical infrastructure continues to transform the city and the state, with the ongoing delivery of new road, tunnel, and rail links to support the competitiveness of industry and business. Queensland's average infrastructure spend from 2000 to 2010 was 75% higher than the average of other states and territories combined at $1021 per capita.

To plan for future infrastructure as Brisbane grows, Brisbane City Plan 2014 includes a local Government infrastructure plan representing around 1000 future projects worth $2 billion for stormwater, transport, parks, and land for community facilities.

Education

Brisbane is home to three world-class universities, each recognised for the quality of its graduates and research and development initiatives. Griffith University is recognised as one of Australia’s most innovative tertiary institutions - the first to offer degrees in Asian studies and environmental studies.

The Queensland University of Technology is a top Australian university with global connections and a reputation for quality undergraduate and postgraduate courses.

The University of Queensland (UQ) is the oldest university in Queensland. UQ is a founding member of the national Group of Eight, a leading group of Australian universities that conducts a significant portion of all university research in Australia, as well as one of only three Australian universities to be a member of the global Universitas 21, an alliance allowing UQ to offer students unique opportunities to participate in student exchanges and events throughout the world.

There are also several other universities operating in niche fields in and around Brisbane, including Australian Catholic University, Bond University, and University of New England.

Warm and welcoming, Brisbane offers the perfect climate for lifestyle and opportunity, business and leisure. Modern and sophisticated with a growing economy, Brisbane is a city where opportunity and lifestyle go hand-in-hand. An appetite for innovation, a reputation for collaboration, world-class industry capabilities, and a wave of new infrastructure positions Brisbane as one of Australia’s most progressive cities.

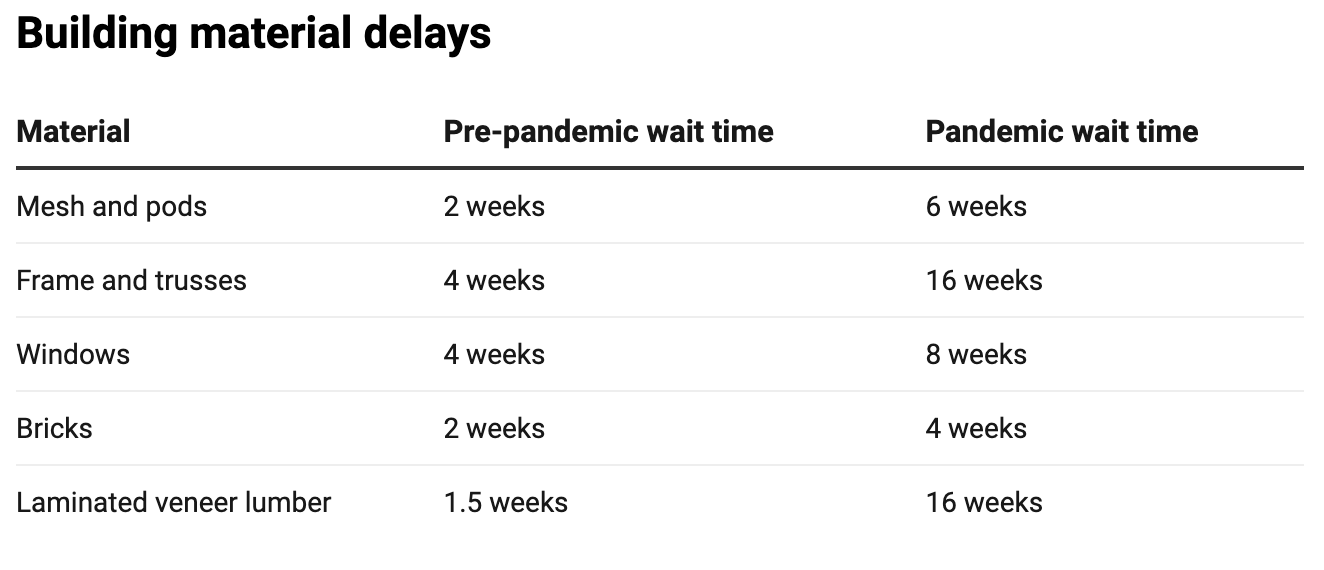

Construction Material Delays

While Australia is experiencing a record-breaking housing boom, the demand for building materials has gone through the roof and builders are struggling to access the supply they need. A shortage of building materials such as timber, bricks, steel, and windows amongst other items has led to costly delays for renovations and new homes.

More homes than ever before are being built in Australia which has been spurred on by generous government stimulus incentives such as the HomeBuilder grant which proved to be more popular than anticipated. Many other countries also used construction as a stimulus and hence there has been global competition for materials.

The housing boom has also collided with a stressed global supply chain for basic materials, a worldwide shipping container shortage, a worldwide timber shortage, and all of this has been on the back of the black summer bushfires which lead to the destruction of softwood plantations. The demand for materials has been tenfold which has lead to supply issues and skyrocketing prices for basic materials up and down the supply chain.

Timber costs

Raw timber is in particularly short supply and builders are no longer being provided with estimated delivery dates due to suppliers not knowing when stock is arriving. Locally produced timber costs are up by between 20 - 25% this year alone, with more increases to come, according to various experts. The cost of framing timber is likely to go up to around $5 a linear metre by the end of the year, up from $3.75 in January.

Imported timber is even more expensive with prices soaring upwards by 90% and more. Part of the reason is that Australian lumber buyers are now competing for supply from Asian mills with American builders, who are in the grip of their own stimulus- and pandemic-inspired construction boom.

Unfortunately, builders are having to wait 16 weeks for laminated veneer lumber, which is a high-strength engineered wood product used for structures, up from around a 1½ week wait before the pandemic. Housing Industry Australia chief economist Tim Reardon said we can expect demand for timber to level out within the next six months.

The table below outlines the delay builders are currently facing on materials including a comparison to pre-pandemic timeframes.

Supply shortage & new builds

Tim Reardon stated that the commencement of new houses in the past 12 months was 20% higher than ever before. A recent HIA report says that Victoria has exceeded 40,000 new starts in a year for the first time.

The supply shortage and heavy increases in price points have not yet hit their peak, meaning the problem may only get worse before the situation improves. The cost to build is likely to increase by approximately $25,000 and build times are going to be heavily pushed out. The approximate time to get a building permit at the moment is 12 weeks, up from 8 weeks pre-pandemic, and then there is an additional few weeks to wait before builders can access the site. Those who are waiting for a build to begin are going to have to muster up as much patience as they've got as delays are going to be the new norm for the foreseeable future.

At PGA Advisory, we are doing everything we can to keep our clients up to date with the progress and status of their builds. While the current shortage of building materials is causing big delays and price increases, we are working hard to ensure our client's journey from beginning to end remain as seamless and smooth as possible. Thankfully, the situation is going to be leveling out at some point, and until then, we are here to answer all of your questions and assist you in any way that we can.

Federal Budget & Real Estate

The Federal Budget for 2021 aims to rebuild our economy and create additional jobs while securing Australia’s economic future. The support will total $507 billion, including $257 billion to directly boost our economy. In this article, we aim to outline all you need to know about the budget and its impact on Australia's real estate market. To conclude, we have briefly outlined the winners and losers of the budget in regards to who is and isn't getting a cash boost.

Personal Income Tax Cuts

One of the major announcements is the introduction of new personal income tax rates. The new rates will provide over 11 million people with $17.8 billion worth of tax savings. It was also announced that by 2024-2025, 95% of taxpayers will pay no more that 30% of their income in tax (proving stage 3 tax changes are passed through Parliament). Essentially, this means that you'll get to keep more of your hard earned money and have more capital to spend, save, or invest. The reduction of personal taxes allows every employed Australian access to more capital in the upcoming years, thereby stimulating consumption which will contribute to boosting the economy. The chart below outlines these new tax savings.

Enterprise Support

From 7th October 2020 until 30th June 2022, businesses with turnover of up to $5 billion will be able to deduct the full cost of eligible depreciable assets of any value in the year they are installed. This allows businesses to reduce the cost of purchasing and installing new assets by claiming full depreciation. This will help most businesses with cash flow, and encourage enterprises to purchase and invest more into the economy. The government will also allow companies with turnover of under $5 billion to offset any losses up to 2021-2022 to be offset against profits made in or after 2018-2019. These measures are expected to create 50,000 jobs by the end of 2021-2022 and boost GDP by $2.5 billion in 2020-2021, and $10 billion in 2021-2022.

Employment support for young people

The 2021 Federal Budget has incorporated two new employment subsidy programs to promote the employment of young Australians: JobMaker Hiring Credit and the JobTrainer Fund. As JobSeeker and JobKeeper begin to wind back in the upcoming months, JobMaker and JobTrainer will seek to replace the existing initiatives. JobMaker is expected to support 450,000 young Australians, allowing businesses to be able to receive $100-$200 per week for hiring an eligible person aged 16-35. Alternatively, JobTrainer will provide school leavers and job seekers access to 340,700 access to free or low-cost training and learning opportunities.

With approximately 40% of job losses between March and August aged 24 or younger, the government has introduced these two initiatives to boost employment for young people. These measures will allow young people access to higher skills training, enhancing their competitiveness in the job market and help encourage enterprises to create more jobs for young people.

Infrastructure Stimulus

In addition to tax cuts for individuals and enterprises, the government also aims to create 40,000 jobs by stimulating infrastructure projects over the next 4 years. Currently, $14 billion has been committed including $7.4 billion for transport infrastructure across the country.

First Home Buyer Subsidies

The 2021 Federal Budget also addresses first home buyers. For first home buyers looking to purchase a new home under the First Home Loan Deposit Scheme, an additional 10,000 opportunities have been made available in 2020-2021 – however these additional places are only available to buyers of new property, not existing property. According to the First Home Loan Deposit Scheme, eligible first home buyers will only need a 5% deposit on a property without the need to pay lenders mortgage insurance. Supporting first home buyers via the first home loan deposit scheme is expected to further support demand in the real estate markets as well as stimulate economic activity through residential construction.

Head of Research at CoreLogic, Eliza Owen has stated that, "while there is evidence to suggest first home buyers prefer established housing, incentives designed specifically for the purchase of new property have been successful in funnelling new demand into new builds. The benefits of such a policy are advocated to be two-fold, creating seemingly easier access to home ownership, as well as generating economic activity in the construction sector."

Family Home Guarantee

The new Family Home Guarantee will allow single parents with a maximum annual income of $125,000 to purchase a home with a minimum deposit of 2% but with local market price ceilings as follows: Sydney - $700,000, Melbourne - $600,000 and Brisbane - $475,000. The scheme is also limited to 10,000 places.

What impact does all of this have on the real estate market?

According to the latest Westpac Research Institution report, Australia’s consumer confidence index rose 11.9% in October, reaching record levels since July 2018. The index is also 10% higher than the average levels in the six months prior to the pandemic. More specifically, another index shows that confidence in the housing market is booming, with a 10.6% increase, reaching the highest level since September 2019. This boom in consumer and housing market confidence is an extremely positive sign for the real estate market. Westpac’s chief economist, Bill Evans said that this significant rebound in consumer confidence is caused by a number of reasons including the reaction to the federal budget, Australia’s successful control of covid-19 and the potential of the Reserve Bank cutting interest rates further.

Housing Prices

In terms of housing price trends, according to the latest data from CoreLogic from September 2020, 3 of the 5 largest cities experienced growth over the month, whilst Sydney and Melbourne pulled back slightly by 0.3% and 0.9% respectively. Over the year, 4 of the 5 cities experienced capital growth ranging from 3.1% to 7.7%.

Rental Return

With interest rates readily available at only 2.5% to 3% for investment loan products, the following table shows that all major cities across Australia have strong rental return rates, especially from Brisbane, Adelaide, Perth and Gold Coast. This means that many investments across the country can be easily geared so that they are cash flow positive.

Vacancy Rates

Despite some challenging months throughout the year, many rental markets across the country are now stronger than pre-COVID levels. SQM Data shows that Perth, Brisbane, Adelaide and the Gold Coast had tighter rental markets in September, compared to March this year. Sydney and Melbourne have experienced an easing in their vacancy rates, reflecting the high demand nature of these markets from international migrants. Although the rental markets have softened, investors need to stay focused on the long term investment, and fundamentals underlying these markets. In time, international migration will return, and is anticipated to return in force, at which point its expected these vacancy rates will tighten again.

Future Market Outlook

In light of all the recent news and Federal Budget updates, Westpac's forecast showcases that housing prices are expected to increase by 10% or more across all five major capital cities in Australia by 2023. Among them, Brisbane is expected to lead the country with its market rising a massive 20%.

Winners and Losers

We also wanted to briefly outline the winners and losers when it comes to who is getting a cash boost in the 2021 federal budget. For more information, head to abc.net.au.

The Federal Budget 2020-21 offers crucial insights into where our economy is heading in the years to come. With a key focus on jobs, the Government is clearly focused on strengthening our economy as quickly as possible to ensure every Australian has the best employment opportunities possible.

Not surprisingly, this has resulted in surging consumer confidence after several months of uncertainty caused by COVID-19. This confidence is key to residential market activity, and will help to underpin demand moving forward.

What is an ETF?

An exchange traded fund (ETF) is a managed fund that is traded on the stock exchange. When you purchase ETFs you are buying a basket of shares or assets. They are a low-cost way to earn a return similar to an index or a commodity and they can also help to diversify your investments. Units can be bought or sold though a stockbroker, the same way that you buy and sell shares.

ETFs come in different shapes and sizes including, shares or bonds, domestic or international, small cap or large cap, hedged or unhedged. They can also be sector specific products such as commodities, property, gold, oil and banks. There are even diversified ETFs that offer low-cost access to thousands of securities across a wide variety of asset classes in a single trade.

How do ETFs work?

In Australia, most ETFs are a passive investment that don't try to outperform the market. The roll of the fund manager is to track the value of both an index, for example the ASX200 or S&P500, and a specific commodity, such as gold. The value of the ETF rises or falls with the index or asset they are tracking.

Types of ETFs

ETFs can be either physically-backed or synthetic.

Physically-backed ETFs invests in all of the securities in the index or a sample of the securities in the index.

In relation to financial assets, a security is an investment such as shares or bonds that can be traded in financial markets.

Synthetic ETFs hold some of the underlying assets and use swaps to copy the movements of an index or asset. If an ETF is synthetic, it must use the word 'synthetic' in its name. Synthetic ETFs have an additional risk that the counter-party in the swap agreement could fail.

In a swap agreement, a counter-party agrees to pay the difference between the value of the ETF's assets and the value of the assets or index it is designed to track. When a synthetic ETF enters a swap agreement, this creates counter-party risk.

When you invest in an ETF, you don't own the underlying investments. You own units in the ETF and the ETF provider owns the shares or assets.

Advantages of investing in ETFs

Diversification: ETFs allow you to buy a basket of shares or assets in a single trade. This can help to diversify within an asset class. ETFs allow you to invest in markets or assets it can be difficult or expensive to access. You can also diversify across ETFs so there's less chance of loss if an ETF provider collapses.

Transparency: ETFs publish the Net Asset Value (NAV) daily on the ASX. This can help you track how the underlying assets are performing and if the price of the ETF is close to the NAV.

Low cost: Many ETFs have a low management expense ratio (MER). They're usually cheaper than most actively managed funds.

Easy to trade: You can buy and sell ETFs during the trading hours of the exchange.

Disadvantages of investing in ETFs

Market or sector risk: While ETFs can help you diversify, the market or sector the ETF is tracking could fall in value. For example, if the ASX200 declines, the value of your ETF investment will also fall.

Currency risk: If the ETF invests in international assets, you face the risk of currency movements impacting your returns. Some ETFs are 'currency hedged' which removes this risk.

Liquidity risk: Some ETFs invest in assets that are not liquid, such as emerging market debt. This can make it difficult at times for the ETF provider to create or redeem securities.

Tracking errors: An ETF's price can move away from the value of the index or asset it's designed to track. This can be due to illiquidity of the underlying assets, fees, taxes and other factors. This means you could buy or sell when it's not trading at the NAV.

Fees and costs

ETFs are generally a low-cost investment and substantially lower in cost than investing in the same exposure of individually purchased shares. An ETF's management fee is made up of the issuer's responsible entity fee and recoverable expenses. The management fee is calculated daily and deducted from the fund's NAV. There may be other fee and costs charged within the ETF, so check the product disclosure statement before you invest. In addition to this, brokers fees are charged when you buy or sell an ETF to cover the cost of completing the transaction on the stock exchange.

A product disclosure statement (PDS) contains a lot of information you'll need to know about an ETF. It includes information on what index, sector or asset the ETF returns aims to replicate, the fees and costs, the risks of investing in the ETF, and how to complain if you have a problem with the ETF.

Choosing between ETFs and traditional index managed funds

Your decision will ultimately depend on which type of investment best suits you. Here are some factors to consider:

ETFs

Comfortable trading on the ASX

Make large or irregular investments

Require hands-on control of the price you trade

Managed funds

Prefer to access a single unit price for investing

Make ongoing, small contributions

Want to set up an ongoing automatic investment plan

We hope this article has helped you to make sense of what ETFs are. If you still have some questions, send through an email with as many questions as you've got and we'll do our best to share some more helpful insights.

Entering the Property Market: Alternative Strategies

Australia's property prices are soaring despite predictions that the virus would cause the market to plummet. Recent data from CoreLogic shows that Australian home values surged 2.1% higher in February; the largest month-on-month change in CoreLogic’s national home value index since August 2003. Spurred on by a combination of record low mortgage rates, improving economic conditions, government incentives and low advertised supply levels, Australia's housing market is in the midst of a broad-based boom, according to Tim Lawless from CoreLogic. Housing values are rising across each of the capital cities as well as across the rest of state regions, demonstrating the diverse nature of this housing upswing.

With property prices so far out of reach, how are those wanting to enter the market going to do so? While purchasing in your ideal suburb may not be feasible at the moment, there are alternative approaches to becoming a home-owner.

Before we get into a couple of alternative strategies, you need to remember that your ideal home doesn't necessarily have to be the only property you purchase. Home buyers, particularly young professionals, readily admit that they can’t afford to buy a house in their ideal location yet. As you wait to save for a deposit to purchase in your ideal location, prices continue to rise and there is a big-risk of being priced out of the market.

Buying off-the-plan

Buying off-the-plan allows you to take advantage of government grants and incentives, and also purchase property with a minimal deposit (5% - 10%) and provides time to save (6-18 months i.e. construction period). Oftentimes, this can act as a motivating factor to save faster and smarter. At PGA Advisory, we have witnessed clients reap the benefit of buying off-the-plan for years on end, and we know that when you purchase in a great location, you are one big leap closer to owning your dream home.

Rentvesting

This strategy allows first home buyers to enjoy the generous tax concessions available to other property investors in Australia. As a 'rentvestor' you can live as a tenant in a rented property, whilst being a landlord of a property that you own and rent out. A growing number of young Australian’s have decided to take up this option as they understand how hard it is to outbid an investor who is aided by tax concessions that first home buyer owner-occupiers are not eligible for. This strategy might allow you to buy sooner, as you may be able to afford a property in a cheaper area without having to compromise on where you want to live for employment and lifestyle purposes.

The reality of entering the property market in Australia's capital cities is becoming more and more out of reach, but luckily there are alternative options out there for getting your foot in the door. While your first real estate purchase may not be your dream home, with accurate and considered planning, you will be able to own your dream home in the future. As we always say, the biggest mistake you can make is not having a plan - so get planning!

If you know someone who you think would benefit from reading this article, please forward it on to them. We are always here to discuss any questions you may have, and of course, to help you plan out your way to owning your dream home one step at a time.

Cryptocurrency: Part 2

How to purchase cryptocurrency

Following on from Part 1 of our cryptocurrency article series which covered what cryptocurrencies are and how they work, in this article we'll be diving into what the current top 10 cryptocurrencies are, and how you can go about purchasing crypto. If you haven't had a read of Cryptocurrency: Part 1, we suggest doing so before taking in the information below, especially if you are new to the crypto arena.

There are more than 6,700 different cryptocurrencies that are currently traded publicly, with the total value of all cryptocurrencies coming in at around $1.6 trillion USD. Here are some of the current popular cryptocurrencies at this time.

Popular Cryptocurrencies

According to CoinMarketCap - a cryptocurrency data and analytics provider - the following are the 10 largest trading cryptocurrencies by market capitalisation:

Bitcoin = $1.42 trillion

Ethereum = $270.57 billion

Cardano = $56.52 billion

Binance Coin = $53.81 billion

Tether = $50.15 billion

Polkadot = $45.80 billion

XRP = $27.65 billion

Uniswap = $20.89 billion

Litecoin = $17.63 billion

Chainlink = $16.35 billion

All values listed in AUD. Data current as of March 18, 2021

How much are each of these cryptocurrencies worth?

Bitcoin = $75,717

Ethereum = $2,337

Cardano = $1.767

Binance Coin = $347.04

Tether = $1.282

Polkadot = $47.43

XRP = $0.601

Uniswap = $40.01

Litecoin = $264.71

Chainlink = $39.20

All values listed in AUD. Data current as of March 18, 2021

How do I go about buying cryptocurrency?

Investing in cryptocurrency isn't difficult but what it does take is some thorough self-directed research. We’ve put together 4 clear steps to outline how you can go about beginning your crypto journey.

Step 1: Firstly, you'll need to compare and choose an online exchange or trading platform. Every person has their own preferences and trading goals which will dictate which exchange they choose. Some people want the widest selection of coins, while others are looking for Australian-based and personalised customer-support, some want all the advanced trading features while some are just after the easiest way to buy cryptocurrency and let their investment grow. When choosing an exchange, keep the following things in mind:

Company authenticity and platform security

Ease-of-use

Fees, spreads and any hidden charges

Customer-support

Number of coins offered

Trading features

Educational content

Method of payment

The ability to buy coins direct with AUD (possible with most Australian exchanges)

Take your time, do your research, read customer reviews and look for an exchange that is upfront about who they are and the fees they charge.

Step 2: The next step is signing up. Once you’ve chosen the crypto exchange that suits your needs, signing up is usually pretty straightforward. Choose your username and password, fill in your personal information and set up 2-factor authentication (which gives your account an added layer of security). From there all you have to do is verify your email which will then prompt you to verify your identity (and potentially provide proof of residence). This can all be done in a few short minutes with a passport or another credible form of ID.

Step 3: Then you'll add your bank account and select you payment method. Once you've done this, you'll be able to make deposits into your account which are most commonly free of charge.

Step 4: Now that your account has funds in it, you are free to purchase any type of cryptocurrency you choose. Go to the buy or trade section of your chosen platform and select the cryptocurrency you want to purchase. Then, enter how much AUD you want to invest, or how much of the coin you want to buy, double-check the details are correct and confirm your purchase.

And that is basically it! If you do your research and compare exchanges before choosing one, you’ll be off to a good start. Take your time, make calculated decisions and never invest more than you can afford to lose.

For more information on cryptocurrencies, what they are and what to be cautious of, the Reserve Bank have an article that’s worth a read. Click here to read more.

The following information is intended for informative and educational purposes only and is by no means specific financial advice. The purpose of our articles is to illuminate different facets of the financial world, so that you can make your own informed financial decisions.