On Wednesday the 3rd of May, the cash rate of 3.85% becomes effective. The Reserve Bank of Australia’s (RBA) announcement to increase the cash rate by 25 basis points has put a hold on the joy recently felt by mortgage holders. Read on for an overview of the key market events that unfolded in April.

Outstanding news for mortgage holders has finally been broken! April delivered much-anticipated relief for Australian real estate investors as the cash rate was officially paused at 3.60%, the highest since 2012. This pause comes at the end of 10 consecutive rate rises administered by the RBA. Such an extended stretch of rises is a record-breaking move by the central bank. The RBA board has been deciding to increase the cash rate target by 25 or 50 basis points at every one of their monthly meetings since May 2022.

Before we continue, it may help to recollect why the RBA decides to increase or decrease the cash rate. The RBA uses the cash rate as a means of attempting to influence inflation. Currently, at 7% (measured annually for the year to March, inflation is well in excess of where the RBA aims for it to be, which is 2 to 3 per cent on average. Through increasing the cash rate, or as it is otherwise known, tightening monetary policy, the RBA hopes to decrease inflation and ultimately have it return to the 2 to 3 per cent range.

The relationship between cash rate and inflation is imperfect. However, it is the most powerful tool the RBA has to influence the economy. Fortunately, we are starting to see some promising data emerge that could be interpreted as the extended sequence of cash rate rises, having their desired impact. The Australian monthly Consumer Price Index (CPI) measures the year-on-year change in the price of goods monthly and is used to gauge inflation.

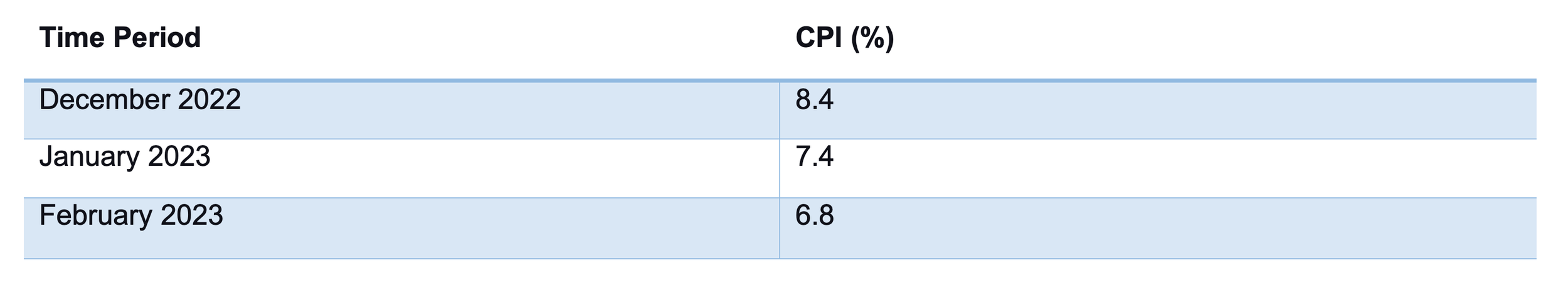

January and February of 2023 have recorded lower CPI figures than their respective previous months, leading to a mini downward trend emerging (see Table 1 for values published by the Australian Bureau of Statistics. Meaning the index indicates that inflation is slowing.

Table 1: All group's Monthly CPI indicator, Australia's annual movements (%)

To provide more context regarding the RBA, consider its three objectives when it comes to monetary policy:

The stability of the currency of Australia

The maintenance of full employment in Australia

The economic prosperity and welfare of the people of Australia

In an attempt to ensure these objectives, get the focus they deserve, the RBA has announced that a second board will be created. Recently, the Australian Financial Review published an article providing in-depth commentary about the creation of this second board. The article advises that one board will handle the bank’s governance, and one will be dedicated to setting interest rates. According to this article, it seems these structural changes have been brought forth after independent reviewers’ recommendations and will be implemented later this year or next year.

Regardless of whether you follow economic news or tend to avoid getting caught up in the headlines, the RBA is a critical force in how our economy operates, which has a bearing on us all. One key criticism of the RBA is that the current board lacks adequate experience in economics and monetary policy. Once a second board is instated, it will be interesting to see the credentials of the individuals that fill it and how they affect monetary policy.

If you're interested in learning more about the cash rate or what can be done to leverage your position, please feel free to contact us!